You might have heard: “Change is only constant in this universe”. This holds even for businesses, especially when there is a driving force from the demand side. It’s hard to pinpoint the invention of the electric car to one inventor or country. Instead, it was a series of breakthroughs. From the battery to the electric motor — in the 1800s that led to the first electric vehicle on the road.

All this while IC powered vehicles were in demand, they still are. The primary reason for electric vehicles (EVs) to take the back seat compared to IC powered vehicles were price, speed and infrastructure availability.

So what changed?

In recent times, electric vehicles have gained popularity. The most prominent reason is their contribution to reducing greenhouse gas (GHG) emissions. Today, the Government of India is pushing the policies for charging facilities, providing subsidies and demand side are overall contributing factors for pulling EV to reality from a dream.

Although in the last 50 years, there have been a lot of changes in the automotive industry, nothing is impacting like EV is impacting the heart and soul of the automotive industry.

The IC Engines will be replaced by the batteries and motors that drive the car/bikes in the coming years. The impact of this move is majorly going to impact the industry suppliers significantly, forcing them to redefine the complete portfolio. Compared to the IC engine development, the R&D team in the electric division has to be quick enough because the speed of innovation in the Electric Vehicle sector is tremendously faster due to its ability to capture massive data.

Impact on stakeholders in the automotive ecosystem

Firstly, as we move to EV, there will be a witnessed change in the Bill of Materials (BOM) because of the moving parts that conventional vehicles use.

The traditional vehicle powertrain consisting of engine, transmission, and drivetrain will be replaced by batteries, motors, and other electronic components such as the control unit, battery management system, and thermal management system. The increased electronic components will further increase the usage of materials like copper, semiconductors and rare earth metals (lithium, cobalt, neodymium).

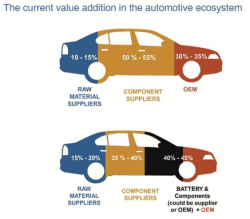

In the new EV equilibrium, raw materials are estimated to contribute 15-20% of the vehicle’s value compared to 10-15%

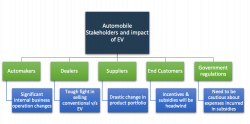

Table 1: Impact of EV on stakeholders

Registration Open - Analyst Program Click here

Electric Vehicle – Impact on Consumers

The above table 1 shows the involved stakeholders, and the impact of change in the automobile industry caused due to introduction of EVs. The relatively most beneficial stakeholder in the entire EV ecosystem is the consumer. Besides that, the automakers will be shelling out a lot of investments in R&D as the EV sector has high momentum of innovation involved.

In fig 1, we can see that the OEM’s value addition will shrink and be limited to chassis, body and vehicle assemble unless battery and motor manufacturing is built in-house with innovative ideas and competitive edge. While only a handful of OEMs in the world knows about the manufacturing of electrodes that go into the battery of EV, the domestic players in India can explore their investment options in such expertise. This will create a moat for the domestic OEMs. It will give a better understanding of batteries (crucial component) and assist in making them more efficient based on customer usage patterns geographically.

Figure 1. Stakeholders share (Conventions V/s EV)

Electric Vehicle – Impact on Dealers

After automakers, dealers are also on the verge of exploitation due to EV because of a tough fight between selling the conventional vs EV to the consumer. Service and spare parts logistics are where the shift will happen. Nearly 15-20% of the revenues are driven by parts and services in the dealer’s income.

Over a five-year ownership period, 40-42 per cent of the expenditure by an IC engine car customer on periodic maintenance is on engine-related parts and consumables. Another 40-42 per cent is on service labour. While in the case of EV, the powertrain has quite different service needs than an IC engine car. In the absence of an engine and a simple gearbox, the number of moving parts in an EV goes down significantly. This eliminates the customer expenditure on engine-related parts and consumables such as filters, oils, and lubricants, further reducing the revenue contribution of features and services.

The story for the dealers looks gloomy, but there is still some hope for them to keep the business lucrative. The sophisticated electronics in EVs will give authorised service centres an edge over roadside mechanics and unauthorised workshops. The current service retention for OEM dealerships after the warranty period ends is between 40-45%. OEMs and dealers need to develop a roadmap for re-skilling of their workforce to capitalise on this future opportunity.

Electric Vehicle – Impact on Suppliers

The suppliers are the most affected in the value chain of the automobile ecosystem as they need to redefine the complete portfolio in less time and heavy investment, and it is a bit challenging for existing players as they need to keep the stock of both products. In the case of EV, many essential ICE systems are absent, like exhaust, fuel system, and transmissions, which makes it more challenging for the suppliers, especially. Those lacking financial flexibility and digital money are likely to struggle the most. Can it be an end to existing companies in such a case? Well, the answer is No.

The major global suppliers have proactively initiated diversifying their business following EV ecosystem requirements. The primary precious metal suppliers like Johnson Matthey have diversified LFP and nickelates for lithium batteries. Similarly, BASF has also commenced its operation by supplying nickel oxides and hydrides for batteries. The casting and forging suppliers, especially aluminium, could diversify their services into lightweight chassis.

As we see, in the absence of significant components like fuel tanks, the manufacturers still can hold the ground as they have competence in heat and impact-resistant plastic development.

Takeaway

It is just that every player in the ecosystem has their own sets of issues, as mentioned above. Despite the problems that will come along the way for every stakeholder in the automobile ecosystem, the EV ecosystem also seems to bring new opportunities in the ecosystem.

Story Contributors: Sanket Chhajed

Other Trending Posts in this Series – Rebel Foods | PVR Cinema | HUL

To stay updated about all of our posts on Businesses and Finance Careers – register and create a free account on our website. You will also get access to a free Finance Bootcamp course once you register.