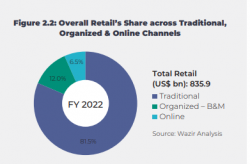

India’s retail market is immense, fueled by its vast population, with key segments including food, groceries, and apparel. Despite a significant portion of the population still patronizing unorganized kirana stores and traditional retailers, there’s a swift rise of organized retail. At the forefront of this wave stands DMart (Avenue Supermarts), a juggernaut in the industry.

Avenue Supermarts operates the highly renowned DMart stores, a name synonymous with low prices every day. With a presence in 23 cities, DMart has become a household name, catering to the daily needs of households across the nation.

In our analysis, we’ll delve into Avenue Supermarts’ operational strategies in a fiercely competitive market with thin margins and strong customer loyalty to local kirana shops. Despite these challenges, Avenue has nearly perfected its operations, and we’ll explore how they’ve achieved this. We’ll then examine key financial metrics to assess profitability. Finally, we’ll discuss future prospects for the company, providing insights into potential growth avenues and challenges. Through this analysis, we aim to gain a comprehensive understanding of Avenue Supermarts’ success and its outlook in the retail landscape.

Introduction:

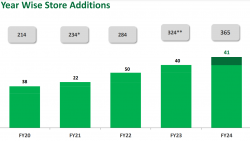

DMart opened its first store in 2002 and today has 365 stores out of which top 3 states (Maharashtra, Gujarat and Telangana) account for 58% and top 5 account for 75% of the total stores – a indication of their cluster-based expansion approach (discussed in detail later)

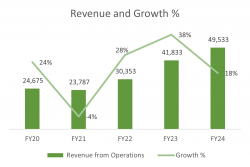

Let’s look at the revenue numbers and growth. The Sales have doubled over the last 5 years

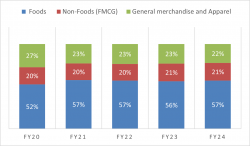

The major categories and their share in revenue over the years is as follows. We can see a very consistent split of revenue between the 3 segments over the past 4 years.

The major subsidiaries of Avenue Supermarts are:

- Align Retail: engaged in the business of packing and selling of grocery products, spices, dry fruits. Its revenue from operations for FY 2024 stood at 2,797Cr and PAT of 33Cr for FY23.

- Avenue Food Plaza: It is engaged in the business of operating food outlets at DMart stores. The revenue from operations of the Company for FY24 stood at 177Cr and loss after tax of 5.8Cr.

- Avenue E Commerce engaged in the business of online and multi-channel grocery retail under the brand name of DMart Ready. Customers can either self-pick up their online orders from any designated DMart Ready Pick-up Points or get them delivered at their doorstep. At most of the Pick-up Points, it also offers a select range of merchandise for instant purchase. AEL’s revenue from operations for FY24 stood at 2,899Cr and a loss of 194 crore in FY23.

A business model like no other

If one looks at DMart from a bird’s eye view – it’s a very simple business – a plain trading business one can say. It buys goods, assorts it and sells it. What makes Avenue interesting is its strategies which have made it the category leader.

- EDLC – EDLP strategy – This is the Everyday low cost and everyday low-price strategy. This is achieved by lowering the costs by streamlining operations, timely payments and avoiding extravagant spends on the look of their stores. The savings thus generated are passed on to the customers all throughout the year unlike other retailers doing so on certain weeks/ days of the year. In a price sensitive nation like India, this is a very crucial aspect which drives the sales of DMart.

- Ownership model of stores – DMart differs from other retail players in this aspect wherein it owns the stores instead of leasing it. While it does entail a significant cost upfront – it also results in cost savings in the long run, not needing to negotiate rentals after every term. Since ownership means a long term commitment – Avenue has to ensure that the location is chosen after thorough research. One of the best examples to illustrate the same is by looking at the DMart stores in Mumbai. There are no DMart stores in the localities of South Mumbai where property prices are high. And thus, DMart serves these through online stores and pickup points (DMart Ready)

- Cluster Based Expansion Approach – DMart focuses on deepening its penetration in areas it already has a presence before expanding to newer The increasing store density helps to keep the supply chain costs low. It also helps in keeping the marketing costs low as they need not market heavily in existing markets.

- Private Labels – Though not a significant chunk as of now, private labels can contribute to margin expansion going forward. DMart has introduced its private labels in many categories and has strategically kept the prices lower than its competitors. For example, Dmart’s brand Premia offers groceries which are priced well below its competitors.

Other factors

- Low to no marketing costs

- Lower payable days – Pays faster than competitors thus demanding lower prices (7.1 days – FY24)

- Utilizing rooftop space to install solar panels to reduce energy costs at the store

The one line that encapsulates the heart of DMart’s philosophy in its annual report is

“Our fundamental business model thrives on the principle of doing more with less. Value retail is more supply chain than retail”

This suggests that while many believe retail success hinges on front-end presentation, DMart’s distinctiveness lies in its unwavering dedication to executing seemingly mundane tasks flawlessly. By prioritizing precision in every aspect of operations, DMart has carved out a unique position in the market, setting itself apart as a pioneer in the industry.

Revenue Drivers –

DMart’s revenue projection can be approached in two ways:

- Multiplying the (number of stores) by the (average number of bill cuts per store) and then by the (revenue per bill cut). Alternatively, the ( total number of bill cuts) can be multiplied directly by the (revenue per bill cut).

- Multiplying the (revenue per retail business area square foot) by the( total retail business area).

1. Number of stores:

DMart has added over 40 stores in each of the last couple of years. This number should increase in the years to come as DMart enters new states and furthers its expansion in existing states.

DMart store count for the population it serves is very low if one compares it with global retailers such as Costco and Walmart and thus has a huge potential to grow in the years to come. Walmart has a store per 100,00 people in US and Dmart can reach over 7000 stores if it achieves the same in India.

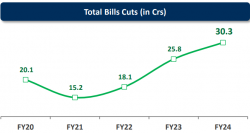

2. Total Bill Cuts:

This is an important metric but needs to be seen in parallel with store/ Area added in the year. Addition of 40 stores implies that the Bill Cuts increase to around 29 Cr but since in reality new stores have a gestation period, the number of 30.3 Cr indicates a healthy growth.

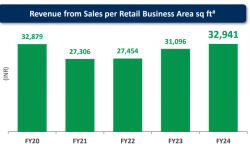

3. Revenue per sq ft retail area:

This is an important metric as it indicates how efficiently the business is using its space in order to drive revenues. We can see that the number has increased steadily and has reached pre covid levels.

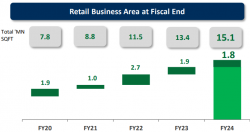

4. Retail Business area:

Revenue is directly related to the retail business area as DMart can stock up more SKUs which can drive revenues. We can see an increase of 1.8Mn Sq ft which indicates that the average size of the store is 45,000 sq ft. This indicates a growth from an average size of around 41,000 sq ft in FY23.

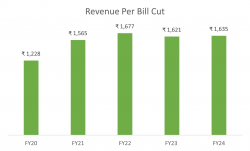

5. Revenue per bill Cut

This is important as it indicates the amount spent on a single visit and DMart would like to maximize this as much as possible. The same can be done through the premiumization trend and by introducing SKUs which have higher average price.

Cost Drivers:

Since it is in a trading business, the major cost component for DMart is purchases of stock in Trade (around 85%) which refers to all the purchases of finished goods that the company buys towards conducting its business.

One of the other major components is the employee cost which accounts for nearly 2% which is significantly lower as compared to its global counterparts such as Walmart (nearly 7.5%)

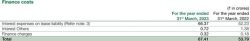

The finance costs for the company is negligible as it paid off its debt through the funds it raised via QIP and IPO. Major component of the finance cost is the interest expense on lease liability.

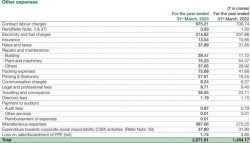

The final cost driver are the other expenses which consist of contract labour charges, electricity and fuel charges and miscellaneous expenses as major heads.

The company has almost no debt. It has paid off its debt by raising money.

Profitability:

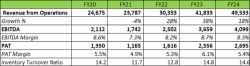

The revenue growth has been phenomenal for DMart on an already large base – This shows how underpenetrated the organized retail market is in India. The margins have remained within tight bounds and are low as expected in retail which is more of a volume game. The average EBITDA margin is 8.2% and average PAT margin is 5.4%. We can also see that the inventory turnover ratio has been fairly constant which hints at superior inventory management which is one of the primary reasons of DMart’s success.

What the Future has to offer:

One of the key challenges facing Avenue Supermarts is the increasing competition from Quick commerce (Q-commerce) players such as Zepto, Instamart, and Blinkit. These platforms have witnessed a significant surge in demand, driven by the urban demographic’s inclination towards the convenience of home delivery with swift turnaround times. However, Avenue Supermarts, leveraging its extensive product assortment and competitive pricing, particularly with its private labels, maintains a distinct advantage in the market. This advantage is further amplified by the purchasing behavior of the middle-class populace, who typically prefer consolidating their monthly shopping needs in one go—a service that Q-commerce players struggle to replicate with their standard delivery fleet. Furthermore, Avenue Supermarts has fortified its position in the digital landscape through its proprietary app, DMart Ready, providing customers with the convenience of browsing and selecting products from the comfort of their homes. Thus, the delivery time remains the only differentiator and is of importance particularly to the segment of high-earning consumers.

In the landscape of DMart’s apparel business, notable competitors such as Zudio have emerged, offering a diverse array of apparel options at competitive prices. However, it’s imperative to recognize that fashion remains a secondary revenue segment for Avenue, with customers primarily engaging with apparel purchases alongside their grocery and food shopping experiences. Therefore, while Zudio and similar players pose a challenge in the market, the impact on Avenue’s core business is mitigated by the distinct customer behavior and purchasing patterns.

Dmart’s biggest competitor is Reliance Retail which is India’s largest retailer and clocks revenue which is 2-2.5x of Dmart’s. But, since the market in India is so large and with the transitioning of the space into Organised retail – both the players have a chance to grow their businesses.

Thus, to conclude Avenue Supermarts has a business model that is very difficult to replicate and excel at. Despite trading at high valuations, the opportunity in the retail space is immense and DMart stands strong to take advantage of this opportunity.

Story Contributors: Aakash Kedia, Saloni Munshi

Read some of our other blogs simplifying business models – Zomato, HUL, Nykaa.