Delhivery is an Indian logistics and supply chain company, headquartered in Gurgaon. It was founded in 2011 by Sahil Barua, Mohit Tandon, Bhavesh Manglani, Suraj Saharan, and Kapil Bharati.

Initially started with the aim to facilitate deliveries between restaurants & consumers, the company found an even bigger opportunity in India’s e-commerce logistics market and quickly pivoted to capitalize on the same. India’s e-commerce market at the time was increasing exponentially, with Flipkart being founded in 2007 & Snapdeal in 2010, catering to the Indian customer’s increasing demand became difficult. Especially with outdated courier services which were more accustomed to delivering paper documents rather than product packages.

There was a need for faster delivery times, greater delivery reach and robust technology to tie everything together right from handling returns to the cash paid on delivery, which was a preferred mode of payment back then. Delhivery took upon the challenge to solve this problem and today it is a prominent player in the logistics space, providing end-to-end supply chain solutions for online retail companies such as Flipkart, Amazon India, Paytm Mall, Myntra, Snapdeal, etc.

The Indian logistical industry is expected to grow between 8.8% (as reported by LogiMAT India) to 9.5% (as reported by Mordor Intelligence) till the year 2030, This is mainly because of India’s economic growth, supported by factors such as urbanization, industrialization, and rising consumer spending, which are expected to fuel the increased demand for logistics services. As more businesses expand their operations and supply chains, the need for efficient logistics solutions will grow hand in hand.

Historically, the Indian logistics market has grown with a growth rate between 9 – 10% over the previous years with 2023-2024 being an exception with a growth rate of 15%. This shows a steady recovery after the market went through a slowdown in 2020 due to the global pandemic.

The rapid expansion of the e-commerce sector in India is also a major driver of growth for the logistics industry. With the increasing popularity of online shopping, there is a surge in demand for reliable last-mile delivery, warehousing, and fulfilment services. Logistics providers catering to the e- commerce segment are expected to experience substantial growth opportunities because of this.

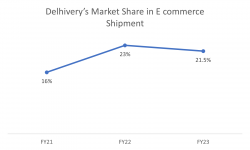

Despite the opportunities stemming from the e-commerce sector, Delhivery needs to work on capitalizing them. Despite significant growth in market share from FY 2021 from 16% to 23% in FY 2022, its share in e-commerce shipments slipped to 21.5% in FY 2023 according to a report by brokerage firm Bernstein. The report also highlighted that the market share gains in FY2022 were due to new clients such as the Singaporean e-commerce company, Shopee and the scale up of existing clients such as the Indian shopping platform, Meesho.

The shutdown of Shopee’s Indian operations severely hurt Delhivery’s market share during FY23. Another blow came from Delhivery’s customers have also reported peak season handling issues such as delivering shipments to the incorrect address and then failing to track them back resulting in losses to businesses and repeat customers.

Delhivery’s core business segments include:

- Express Parcel Services – They are specialized courier services focused on fast and reliable delivery of parcels and packages. They offer expedited shipping options, often guaranteeing next-day or same-day delivery for domestic shipments. These services prioritize tracking and visibility, allowing customers to monitor their parcels in real-time.

- Part Truck Load Services – These involve shipping freight that does not require a full truck for transportation. Instead, multiple shipments from different customers are consolidated into a single truckload. PTL providers offer cost-effective solutions for transporting smaller quantities of freight, as customers pay only for the space they use. These services provide flexibility in scheduling pickups and deliveries, accommodating varying shipment sizes and destinations.

- Truck Load Services – These services involve transporting freight that fills an entire truck, typically from a single customer. Truck Load shipments occupy the entire capacity of the truck and are not shared with other shipments. These services are suitable for large-volume shipments or shipments that require dedicated transport without stops or transfers.

- Supply Chain Services – Encompasses a range of activities involved in the management and optimization of product flows from the point of origin to consumption. These services include sourcing, procurement, production planning, inventory management, logistics, and distribution.

- Cross Border Services – Includes facilitating the movement of goods, services, or funds across international borders. These services encompass customs clearance, import/export documentation, and compliance with regulatory requirements.

Delhivery Revenue Drivers:

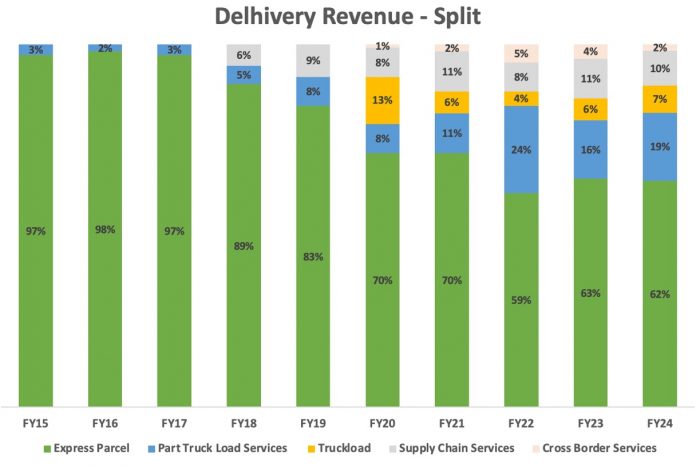

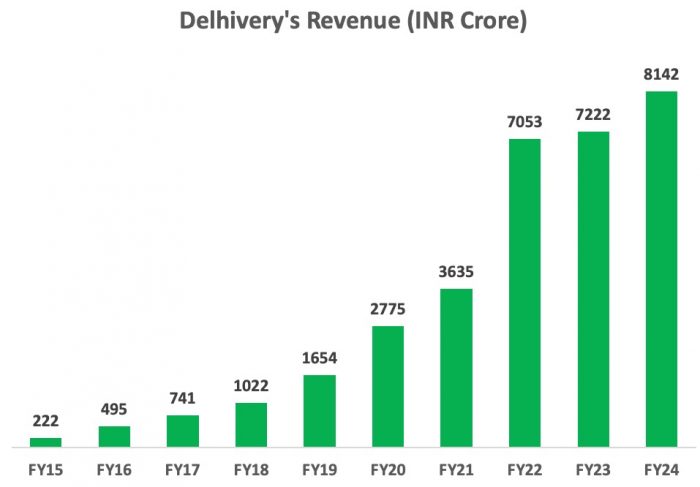

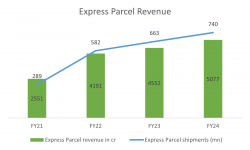

- Express Parcel Services: These services contribute to around 60% of Delhivery’s revenue and have grown at a CAGR of 26% from FY2021 to FY2024. Interestingly, Delhivery made a revenue of ₹68 per shipment on an average which has stayed exactly the same from 2023 to 2024 while revenue grew by 11.5% indicating better volume performance. Major clients include Nestasia, Meesho, Fabric Pandit, etc.

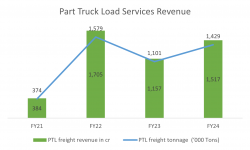

Part Truck Load Services (PTL): Delhivery’s part truck load business has seen a major decline in revenue from 2022 to 2023 of about 32%, having recovered in 2024 by 31% over 2023 level, it still lags behind when compared to its 2022 peak. This decline is mainly due to Delhivery acquiring Spoton Logistics in 2021. Delhivery saw the opportunity to integrate Spoton, the B2B- focused logistics firm because of its part truck load service (PTL). However, major issues developed when Delhivery tried to merge operations. According to a report by the Arc, Delhivery moved too quickly to integrate Spoton and perhaps underestimated the scope of the task. It also proved to be difficult for Delhivery to merge Spoton’s tech stack focused on B2B cargo, into Delhivery’s proprietary mesh network.

Part Truck Load Services (PTL): Delhivery’s part truck load business has seen a major decline in revenue from 2022 to 2023 of about 32%, having recovered in 2024 by 31% over 2023 level, it still lags behind when compared to its 2022 peak. This decline is mainly due to Delhivery acquiring Spoton Logistics in 2021. Delhivery saw the opportunity to integrate Spoton, the B2B- focused logistics firm because of its part truck load service (PTL). However, major issues developed when Delhivery tried to merge operations. According to a report by the Arc, Delhivery moved too quickly to integrate Spoton and perhaps underestimated the scope of the task. It also proved to be difficult for Delhivery to merge Spoton’s tech stack focused on B2B cargo, into Delhivery’s proprietary mesh network.

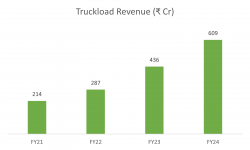

- Truckload (TL): There was a 3X growth in truck load revenue between FY21 and FY24, from 214 crores in FY21 to 609 crores in FY24. Substantial growth is mainly due to Volvo’s partnership with Delhivery wherein 26 custom built Volvo trucks were first added to its fleet towards the end of 2019. These trucks promised to revolutionize the industry by being more efficient while also increasing productivity thanks to higher vehicle uptime. With each truck having the capacity to run 25,000kms in a month, that’s a staggering 1,25,00,000 km or 1.25 crore kms worth of shipments for Delhivery every month!

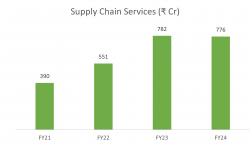

- Supply Chain Services: Delhivery continues to add new clients in auto & auto spare parts, healthcare, home furnishing, beauty & personal care and consumer electronics. With the completion of the acquisition of Algorhythm Technologies in January, 2023, Delhivery plans to enhance their SCS (Supply Chain Services) offerings with inventory management and transport optimization solutions. The revenue from SCS has slightly dipped by 1% in FY2024. Supply chain services require a large amount of capital expenditure and have a longer turnaround time. Having onboarded new clients for SCS in FY2024, the revenue stream could be expected the following year.

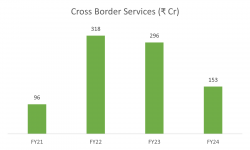

- Cross-border services: These form a smaller chunk of the company’s revenue and has declined from FY 2022’s peak (318 crores revenue) to FY 2024 (153 crores revenue). This is largely because Delhivery is focusing only on ocean freight in FY 2024 as opposed to ocean and air freight in FY 2022.

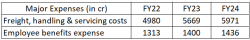

Cost Drivers:

Delhivery’s largest costs were associated with its logistics business. Costs such as Freight handling and servicing made up around 73% of the total cost in FY24. For any logistics company this is the area where they can optimise their processes so as to make more profit per rupee spent on the cost of moving those goods, however this is easier said than done for Delhivery as they already charge less as compared to the competition for moving those goods.

The company has increased its headcount from FY22 to FY23 but the employee benefits have not increased in the same ratio. This is partly due to a one-time employee bonus being given in FY22 but largely looks like Delhivery have cut costs on employees.

Comparing Delhivery’s freight costs to Bluedart gives us a better idea of how much efficiency Delhivery is yet to incorporate into its operations. For every Rupee spent in FY 2023 on freight costs, Bluedart generated ₹ 1.45 of revenue while Delhivery made ₹ 1.27.

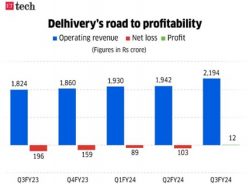

Profitability:

In the third quarter of FY24, Delhivery achieved profitability. Delhivery disclosed a Profit After Tax (PAT) of Rs 12 crore during this period. It witnessed robust growth across its Express Parcel and Part Truckload (PTL) segments thanks to the festive season having boosted revenues. However, Delhivery reported a loss of Rs 69 crore in Q4 FY24. They ended the year with a net loss of Rs 250 crores for the year FY24.

With existing clients like Meesho moving towards proprietary logistic solutions like Valmo and the difficult integration of Spoton’s business with its own, Delhivery is facing some challenges. These issues are further catalysed by recent high profile exits at the firm. However, the company sits at the helm of huge opportunities when it comes to the Indian e-commerce industry. Sugar Cosmetics joining hands with Delhivery to partner up for utilizing the part truck load services along with pre-existing express parcel services is the beginning of capitalizing on said opportunities.

Concluding Remarks:

Delhivery seems to be poised for profitability with its strategic initiatives and strong market positioning especially in PTL services. By focusing on scaling operations, optimizing efficiency, and diversifying services, Delhivery aims to achieve economies of scale and capture new revenue streams. This seems to be no easy feat considering the highly fragmented Indian logistics landscape. Armed with technology, will Delhivery move towards sustained profitability and grow further in the dynamic logistics landscape? Only time will tell.

Story Contributors: Abhinav Acharya, Saloni Munshi

Read some of our other blogs simplifying business models – Zomato, HUL, Nykaa.