This article on Tesla Valuation was one of the winning entries as a part of the FinShiksha Writer’s Cut Competition.

Author: Shreya Chawla, NMIMS Mumbai

With the current market capitalization of $635 billion (as of 10th March 2021), Tesla has become the fifth most valuable company on Wall Street.

We saw its stock price skyrocketing in the last year. How did the stock price more than quadruple in 2020 despite not-so-impressive gross margins? From being on the brink of bankruptcy at the beginning of 2020 amidst ramping up its production to enjoying a crazy rich valuation ever since let’s explore the story of the world’s buzziest electric vehicle company.

On 17th March 2020, Tesla’s stock price hit a low of $79. It hit a high of $895 on 26th January 2021, and Elon Musk himself claimed that Tesla’s stock was overpriced. The incredible rise is evident from the graph below –

Inclusion in the Index

Now let’s delve deeper into the reasons which led to the surge in Tesla valuation.

As we know, the stock prices are influenced by speculations, and there was an expectation that Tesla would become a part of the S&P 500 Index after it declared its quarterly results on July 22, 2020.

S&P Index is a market index that tracks the performance of 500 companies listed on the US Stock Exchange. To be a part of the S&P 500, companies need to issue common stock and have a market capitalization of at least $8.2 billion. They need to be based out of the US and be listed on an American Stock Exchange. Lastly, the companies should have positive earnings in the most recent quarter and the four most recent quarters.

As for Tesla, it had been profitable in the last three quarters, and its inclusion in the index was contingent on the results of the quarter ending July 22, 2020. There was an expectation that Tesla might become a part of the S&P 500, and this expectation led to more people buying Tesla’s stock, thereby leading to a surge in stock price.

Despite Tesla halting its production in a California plant amidst the Pandemic, it reported a net profit of $104 million in the quarter ending July 2020.

What happens with Tesla’s inclusion in the index can be explained by passive portfolio management strategies. The fund attempts to copy or mirror the benchmark index performance by holding the group of stocks in the same proportion as they are in an index, such as the S&P 500.

When a company replaces another company in an Index, the index funds would have to buy the company’s stocks which got included and sell off the company’s stock which got replaced. In this case, people were buying huge volumes of Tesla’s stock, thereby driving the price. Historically, whenever a company gets included in an index, we see a runup in its share price. The same happened in 1999 and 2005 when Yahoo and Amazon were included in S&P 500, respectively.

Registration Open - Analyst Program Click here

Tesla Valuation

Now the question is whether Tesla would be able to sustain such high stock prices. In my opinion, Tesla valuation, albeit a little hyped, also reflects the sign of times to come. Here’s why.

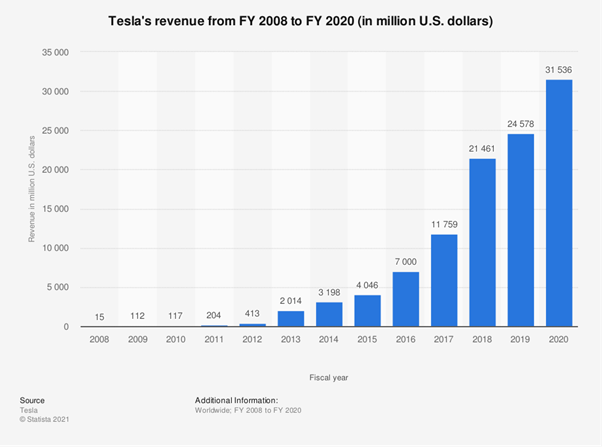

Firstly, the electric vehicle industry is set to take off. The current EV market is just a small blip as to the size it is going to be in the next 10 to 20 years. As per Bloomberg New Energy Initiatives Report, 60 million EVs would be sold by 2040. Owing to reducing dependence on oil and gas in the future, Tesla sounds like an extremely durable business model with high growth potential. As shown in the graph below, Tesla can boast an impressive top-line because it shows the basic principles of compound growth. Going by this exponential growth, the 2030 revenues may hit the $1 trillion mark.

Secondly, Let’s have a look at some fundamentals and investment metrics of Tesla –

| Q1 FY 2020 | Q2 FY 2020 | Q3 FY 2020 | Q4 FY 2020 | |

| Total Revenue (in $ million) | 5.98 | 6.03 | 8.77 | 10.74 |

| Net income (in $ million) | 0.016 | 0.104 | 0.3 | 0.27 |

| Net Cash Flow (in $ million) | 1.76 | 0.56 | 5.8 | 4.8 |

| Gross Profit margin | 21% | 21% | 24% | 19% |

| Net Profit margin | 0% | 2% | 3% | 3% |

| Earnings per share (in $) | 0.02 | 0.1 | 0.27 | 0.24 |

| 2020 (Actual) | 2021 (Forecasted) | 2022 (Forecasted) | 2023 (Forecasted) | |

| P/E ratio | 1083.95 | 259.82 | 164 | 128.47 |

| PEG ratio | 0.82 | 2.81 |

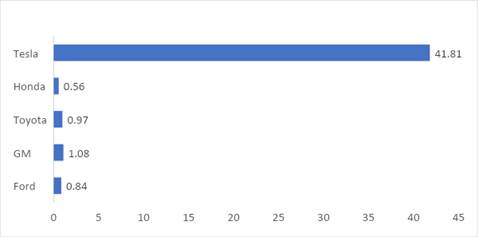

Tesla’s revenues, net margins and EPS are steadily increasing over the last 4 quarters. It has a positive diluted EPS, and its net margins are increasing. Its gross margins are pretty impressive, considering the automobile industry, which is highly capital intensive. As it produces more cars, the economies of scale will push up the margins even further. Though its price to earnings ratio of 1083.95 is extremely high, suggesting that the stock is overvalued, its forecasted Price-earnings-growth ratio is low at 0.82 (<1), suggesting that it is being paid less for future earnings growth and has very high growth potential. Its EPS may be very low compared to its high stock price, but it is priced for earnings to grow. Since Tesla is currently at a hyper-growth stage, it is not paying any dividends. Despite being asset-heavy, it has a strong cash position of $19.4 million as of 31st December 2020. Some fundamentals might look weak, but most fundamentals under the hood make it look pretty strong. Let’s have a look at the Market to Book Value Ratio of major automobile companies –

The Market-to-book value ratios of most automobile manufacturers are close to 1, indicating that the investors are paying close to book value. But for Tesla, investors are willing to pay a huge premium over and above what its assets are worth because they are pricing in its future growth potential early on.

Thirdly, stock markets may work differently when it comes to big technology companies with high-growth potential. Tesla may be selling at an ‘unreasonable’ price currently; however, it seems rational to bet in favour of the stock as long as it is capitalizing on big technological trends. Elon Musk is looking at long-term technological transformation and has forecasted rapidly increasing margins from electric vehicles, battery technology and autonomous driving. Stock Markets are more complex than most people assume, and sometimes just the future growth potential may override the overarching conventional principles of value investing.

Let’s do some number crunching to assess Tesla’s market potential by 2030.

| 2030 estimates ($) | |

| Cars to be sold | 20 million |

| Average price per Car | $50,000 |

| Car Sales Revenue | $1 trillion |

| Net Profit Margin | 10% |

| Net profit | $100 billion |

| Average market price to earnings ratio | 15 |

| Tesla’s value from the Car business | $1.5 trillion |

| Tesla’s value from the energy business | $1.5 trillion |

| Tesla’s total market cap | >$3 trillion |

Verdict

The year 2020 alone saw 500,000 vehicles being produced and delivered. Tesla is rapidly expanding its manufacturing capabilities, and Elon Musk has projected an ambitious 20 million cars to be sold by 2030. Assuming the average price of the vehicle sold to be $50,000, the car sales revenue by 2030 can be $1 trillion (20 million* $50,000). With a net profit margin of 10%, it can generate $100 billion of profit by 2030. Assuming the average market price to earnings ratio at the current rate of 15, Tesla could be worth $1.5 trillion by 2030 if all goes well.

Thus, the intrinsic value of purely the car side of the business is worth $1.5 trillion. Add to that the potential of Tesla’s energy segment. By integrating residential solar roofs and residential storage with software that allows people to track energy consumption, Tesla is all set to capitalize on the huge opportunity of climate change.

Elon Musk values this segment at par with their automotive segment, if not more. This brings another $1.5 trillion value to Tesla. Besides these two segments, Tesla is also eyeing the ride-hailing and insurance services, which will add somewhat to the company’s value. Thus, Tesla valuation could very well exceed the $3 trillion market capitalization by 2030.

Therefore, the high stock prices of Tesla reflect its future potential of dominating electricity markets. Based on the above analysis, I feel that Tesla can change the game and become the next wonder stock, and its share price is a sign of times to come.

Note: Views expressed are the author’s opinion. FinShiksha does not endorse or recommend any of the opinions. The companies and stock prices mentioned are only for educational purposes. This is not to be seen as a recommendation to buy or sell any securities. FinShiksha is not a registered investment advisor, and any investment decisions should be taken in consultation with your advisor.

This article was written in March 2021. The stock prices may have moved since – kindly view this with the perspective of analyzing the company business.

Other Trending Posts in this Series – HUL | Titan | Amazon

To stay updated about all of our posts on Businesses and Finance Careers – register and create a free account on our website. You will also get access to a free Finance Bootcamp course once you register.