A quick read on ICICI Bank and its Cost drivers. Credit growth in India has slowed down in the last two years. Growth in deposits has consistently outpaced growth in credit since June 2019. Due to sluggish demand, disruptions caused by the Covid-19 pandemic, and balance sheet deleveraging by large corporates, the credit growth has been muted.

The credit offtake has improved recently as business activities are picking up and corporates are showing interest in re-leveraging. Credit growth has continued to be bolstered by retail/personal and micro, small, and medium enterprises (MSME) segments.

According to the RBI, bank credit stood at Rs. 116.8 lakh crore (US$ 1.56 trillion) on 31st December 2021. As of February 2022, credit to non-food industries stood at Rs. 114.10 trillion (US$ 1.53 trillion). ICICI Bank has ~7% market share in this context.

After witnessing modest credit growth in the recent years, the outlook for bank credit growth has been positive due to economic expansion, a rise in government and private capex (especially capex for renewables and production linked incentive (PLI) schemes), extended ECLGS support, inflation of commodity prices, and retail credit push coupled with the fact that the third wave of Covid-19 (omicron) was not as severe as the first two.

Let’s deep-dive.

ICICI Bank – Drivers of growth

The return on Assets (ROA) of a bank depends on the three engines of growth: cost of funds, credit cost, and operating cost. This is likely to play out in ICICI Bank’s favor in the coming days.

Cost of funds

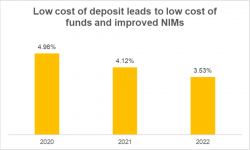

ICICI Bank is evenly placed to play the upcycle with a healthy retail mix aided by a CASA ratio of 45.2% (YoY growth of 20.1%). The focus on retail deposits has increased since a change in management.

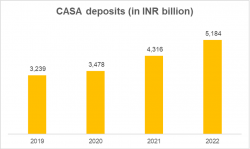

The CASA deposits have increased by 60% during the last four years. As a sticky source of low-cost deposits, this provides enough room for the bank to expand its net interest margin (NIM).

The bank’s strategy of shifting towards retail lending has improved NIMs. NIMs stand at 4% in Q4FY22 vs. 3.96% in Q3FY22 and 3.84% in Q4FY21. During the quarter, NIM expansion was driven by yield improvement of 12bps QoQ. The management remains confident in maintaining NIMs of 3.95-4%.

Credit Cost

Improved asset quality is a function of low credit cost, and the bank is rewarded for prudent lending practices.

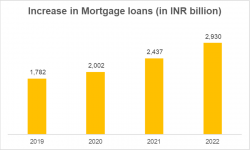

The loan book of banks indicates 52.9% attribution to the retail segment. Out of this, 34.1% is related to mortgages which assure asset quality.

Moreover, the change in management with Mr. Sandeev Bakshi as the CEO has focussed on improving the corporate loan book. 46.3% of the loans granted to corporates till March 2018 have a rating of A- and above. This has been enhanced to 71.8% in March 2022.

ICICI Bank seems to have learned the lessons from the last business cycle where corporate loans severely impacted nIMs. About 41% of the loan book is linked to the repo, and even in an increasing rate regime, the bank is expected to report better NIMs.

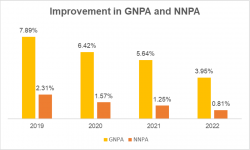

Closing Gross Non Performing Assets (GNPA) for FY21 stood at ₹ 413.73 billion, which improved by 22% in FY22 to ₹ 339.2 billion.

While the gross addition during this period has been ₹ 31.68 billion, there have been recoveries to the extent of ₹ 99 billion. This has significantly brought down the Net NPA for the year to ₹ 69.61 billion from ₹ 91.8 billion in March 2021.

The bank is well provisioned at 79.2% as of March 2022. This has improved by 150 bps since last FY.

The business is focussing on a lot of pre-delinquency work management using data analytics which has improved collections. Moreover, the relationship with a customer can be improved if it’s validated that there is a genuine requirement for restructuring.

Operating costs

The employee expenses increased by 21% YoY basis. The bank had 105,800 employees towards the end of FY21, which increased to 112,800 in FY22.

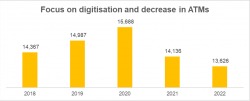

Non-employee expenses have moved northwards due to a significant increase in technology-related expenses. The bank continues to invest in technology to enhance offerings to customers and the scalability, flexibility, and resilience of the technology infrastructure.

Technology expenses stand at ~8% of operating expenses. This is ~3% of the net revenue of the bank. The bank considers spending on tech as a necessity for sustainability, and going forward, the spending on technology expenses should be ~8% of the net revenue.

Registration Open - Analyst Program Click here

ICICI Bank – Fintech collaboration and Digital transformation

ICICI Bank has realized that certain Fintechs who have the potential to address specific client problems and provide solutions can be partnered for cross-selling and reaching out to the Total Addressable Market (TAM). Anup Bagchi of ICICI Bank had talked about the Fintech partnership during Q1FY22 and provided scalability to the plan. Banks with their ability to perform Know Your Customer (KYC) are better in scalability than their fintech partners.

For instance, in iMobile Pay, the bank is witnessing rapid growth in the count of non-ICICI bank customers. There have been 6.3 million activations of iMobile Pay by non-ICICI bank account holders since the end of March. About 34% of mortgage sanctions and 44% of our loan disbursements were digital in FY22.

Corporates have highly appreciated the launch of ICICI STACK. It has created 20 industry-specific STACKs that provide bespoke and purpose-based digital solutions to corporate clients and their ecosystems. The volume of transactions through these solutions in Q3- 2022 was 3.7 times the volume of transactions in Q3-2021.

TradeEmerge has been introduced recently for importers and exporters across India. This initiative makes cross-border trade hassle-free, quick and convenient, as it offers an array of services in one place.

ICICI Bank – Marching towards FY23

Bank credit is currently lower than the nominal rate of GDP growth. The yield of 10-year G-Sec is ~7%, and the mortgage rate is 6.9%. The delta between the mortgage pricing and the 10-year has higher room for growth.

Mortgages of ICICI Bank have been increasing steadily, and it will be the key to growth coupled with the swift change in the business strategy of digital adoption. The bank will continue to pursue growth in a risk-calibrated manner through the focused pursuit of target market segments.

ICICI Bank has been outperforming its peers in the last few quarters. Strong loan growth, improving core operating profits, encouraging asset quality trends, and a strong provision buffer coupled with a stable deposit franchise will help the bank expand ROAE over FY 23-24.

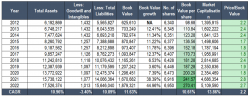

Source: CapIQ data

The bank looks good on the P/ABV front. There is a possibility of re-rating with the continuous demonstration of leadership in digital transformation and best-in-class provision coverage ratio. The strong liability franchise and the addition of utility products in the mix will provide customers with enormous banking opportunities.

Other Trending Posts in this Series – DMart Valuation | HUL | Tesla Valuation

To stay updated about all of our posts on Businesses and Finance Careers – register and create a free account on our website. You will also get access to a free Finance Bootcamp course once you register.

Recent Articles

Top Courses

Next Batch starting Sept 2025 - Join the Waitlist

Next Batch starting Sept 2025 - Join the Waitlist