DMart trades at a massive valuation premium to the other companies listed in the same space in India. We often hear that DMart is an overvalued stock. But why does it continue to get this premium?

I can think of atleast 3 reasons which cause this premium in DMart Valuation

DMart Valuation Premium – Reason 1: Growth & Opportunity

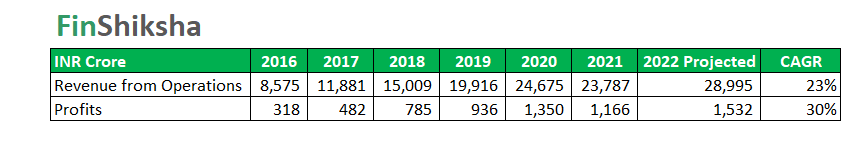

DMart has grown revenues at a CAGR of about 23% and Profits at a CAGR of 30% over the past 6 years. This despite 2021 being affected heavily by the pandemic.

Number of stores has more than doubled, and yet DMart has only 260 odd stores as of now, predominantly in the western and southern regions of India. By any stretch, there is a huge opportunity both in terms of the number of stores, and the area under the stores. To give an idea, CostCo operates more than 80 million square feet of store space in US alone, compared to around 10 million square feet for DMart. You get the drift

Registration Open - Analyst Program Click here

DMart Valuation Premium – Reason 2: Inventory Management

Retail companies can be judged by how well they manage their inventory. Imagine you go to buy a shoe. You walk into a store & like a shoe, but the store manager tells you that the shoe is not available in the size that fits you. What do most of us do in this situation? We will likely go to the next store and buy some other shoe that we like there.

In retail, most of the purchase is on impulse, at that moment. Bad inventory management would either mean lost sales, or obsolete products. This is even more relevant for perishable products like food, where bad inventory management could result in complete loss of value itself.

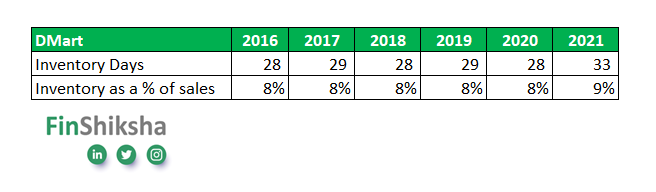

While analyzing a retail business, just look at trends in inventory management. Take DMart for example. Inventory expressed in the form of Days worth of Sales is almost constant at 28 days (Ignore FY2021 since this was hit by the pandemic) for the past 5 years.

A firm that can revolve its inventory in 28 days, will have an inventory turnover of 12 times a year. A retail business thrives on fast moving inventory and gross margin you make every time the inventory is sold.

DMart is the boss in this! There are very few other retail firms that show these kind of numbers. It explains that DMart understands its customers, their needs, and their purchase cycles. It seems simple, but this is a killer competitive advantage in a business that runs on thin margins and is highly competitive!

DMart Valuation Premium – Reason 3: Higher bang for the buck

DMart generates more than twice the revenue per square foot as compared to the other similar retail entities. Once again it is a function of higher inventory turns, and a specific focused category of products. This caters to exactly what the customers need.

Is DMart valuation correct, I am not sure. Does the company deserve a premium, surely yes.

Disclaimer: This is not a recommendation to buy or sell any security.

Other Trending Posts in this Series – Media & Entertainment Industry | HUL | Tesla Valuation

To stay updated about all of our posts on Businesses and Finance Careers – register and create a free account on our website. You will also get access to a free Finance Bootcamp course once you register.