A positive development is coming for customers using UPI as the central bank recently announced that the credit cards can now be linked to UPI. This is going to be tested with Rupay cards and will soon be taken to Visa and Mastercard.

Until now, customers could only link their debit cards to UPI. The move is expected to bring convenience to the customer and improve the scope of digital payments.

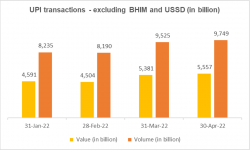

After observing immense success in the debit card ecosystem, Unified Payments Interface has entered its next round of evolution. UPI has the most inclusive mode of payment in the country, with over 260 million unique users and 50 million merchants onboarded on the platform. In May, the platform processed almost 5.95 billion transactions worth Rs 10.40 lakh crore.

The growth in the credit card ecosystem

The total value of credit card transactions is expected to reach INR 51.72 Trn by FY 2027, expanding at a CAGR of 39.22% during the FY 2022 – FY 2027 period The volume of credit card transactions is projected to expand at a CAGR of ~26.43% during the forecast period. In FY 2021, a significant increase in the value of credit card transactions was witnessed. This rise was the result of a surge in the number of transactions per credit card and cardholders. The banking system reported over 1.2 million new credit card additions in November 2021.

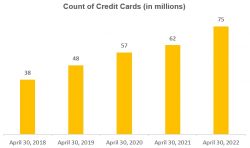

The number of credit cards has almost doubled in the last 4 years and has increased discretionary spending. This seems to be the tip of the iceberg. However, one thing needs to be ascertained on whether the spending has increased due to convenience or due to the betterment of the standard of living of the users.

Currently, there are 75 million credit cards issued in India. However, there are only 35 million unique card holders. In spite of the growth in the industry, the penetration levels have remained extremely low. With the UPI integration, the market penetration is likely to improve.

Registration Open - Analyst Program Click here

UPI and the future of payments

A customer currently links her deposit account to UPI and the payment is done immediately. Once the credit card is linked to the UPI, the customer gets the option to pay later as per the billing cycle of the credit card. This increases options for the cardholder. Typically, small value transactions are being executed through UPI and once the integration with credit cards is implemented, there is a possibility of large value transactions being carried out smoothly. This is going to be revolutionary in India and customers don’t need to carry the plastic card but use the UPI ID for processing transactions.

Merchant Discount Rate (MDR)

There is a downside to this for bankers. A credit card is uniquely placed as compared to a debit card. Debit cards don’t have a Merchant Discount Rate (MDR) on UPI.

A merchant discount rate (MDR) is a user fee on every transaction levied by banks and payment service providers on merchants for providing infrastructure to accept digital payments from their customers. The charge is shared between banks and payment service providers such as RuPay, Visa, Mastercard or Amex involved in the transaction.

MDR is the key source of revenues for the payments ecosystem and credit cards contribute the most. The interest rates on credit cards go beyond 30% in certain cases and is a very profitable business for a bank.

RBI has been trying to put an upper limit on the MDR and in January 2020, the decision was finally made to remove MDR on UPI transactions. This zero MDR policy applied to Rupay as well but they could still continue to earn 0.4-0.9% on credit card transactions. Transactions through Visa and Mastercard debit cards also attract an MDR of 1.65 percent for classic cards and 1.85 percent for premium platinum cards or even higher, as per a Moneycontrol.com report. This high MDR encourages customers to avail opportunities like free lounge or free hotel stays on some of the credit cards. However, the onus lies on the merchant who pays the bill.

Major constraint in UPI and Credit Card integration

The ‘zero MDR’ policy is not likely to exist as credit cards fetch higher margins and the pricing policy needs to evolve now. A discussion needs to be initiated between banks and NPCI which balances the interests of the stakeholders.

Moreover, in case of credit cards, the loss is not limited to MDR. Some part of the spending gets converted into close-ended loans and banks get to earn interest income on it.

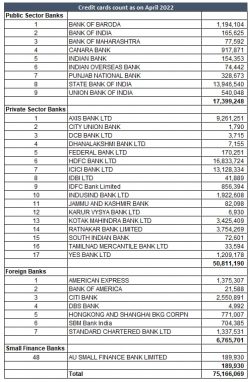

It is evident that HDFC Bank has the largest share of the pie with 39 percent of transactions under its credit card.

NPCI needs to design a ‘win-win’ situation

At this point, the central bank has only introduced the arrangement for UPI and credit cards. Pricing of transaction or interchange fees will be decided in due course, RBI deputy governor T. Rabi Shankar said during his interactions with the media.

It will be interesting to see how things turn out. Merchants have got used to the ‘zero MDR’ policy so far with UPI and this has helped them to save more. With the UPI and credit card integration, if MDR is levied on transactions, it is the merchant who is going to bear the heat. Merchants who operate at a small level will be impacted the most.

We may get to see more cash transactions replacing the UPI in that case and NPCI needs to find a win-win situation for both the bankers and the merchants. For banks, they need to revisit their business model for credit cards and the target market to enhance the scalability of their operations. There needs to be tailor-made cards which would meet the requirements of different user classes and this would help in increasing the market penetration. The increasing volume of transactions through this route may serve them well if NPCI goes completely in favor of the merchant.

Other Trending Posts in this Series – DMart Valuation | HUL | Tesla Valuation

To stay updated about all of our posts on Businesses and Finance Careers – register and create a free account on our website. You will also get access to a free Finance Bootcamp course once you register.