In this company analysis of American Express (AmEx), we will understand credit card economics and what makes AmEx a key player in the credit card industry.

So, the US is the primary market for AmEx and Credit cards are a staple for the US payments ecosystem. It comprises 24% of US consumers total transactions. As of 2020, US consumers’ collective credit card debt accounted for ~$974 Bn. The top 10 card issuers hold ~80% of the credit card balance outstanding. As per the consumer credit report of the Federal Reserve, there were ~45 Bn credit card transactions in 2019, and it was dominated by four major networks (Visa, Mastercard, AmEx, and Discovery), accounting for ~$4 Tn in volume.

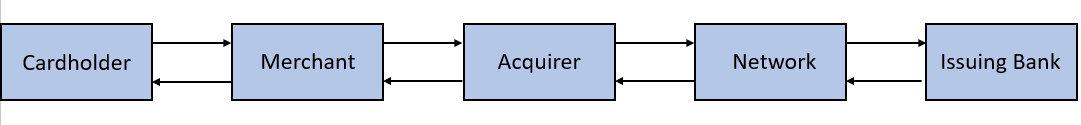

Before we get into the nitty-gritty of the AmEx business, let’s see how credit card transactions work.

The above flowchart represents the process flow of credit card transactions and the parties involved in the transactions. The entire transaction at the point of purchase (Merchant) is processed within seconds.

Cardholder makes the purchase with a credit card at a Merchant (any physical or online store) –>

The merchant sends the transaction data, including cardholder details to the acquirer (acquiring bank where the merchant has an account) –>

The acquirer sends the data to the credit card network (process the transactions) to verify the details of the transaction with the Issuer bank (where the cardholder has an account) –>

The issuer varies the data and sends it back through the credit card network to process the transactions at Merchant.

If we talk about the market players, the acquirer and issuing bank are the banking and financial services institutions (Example, CITI bank, ICICI, HDFC, etc.). Visa and Mastercard are network service providers.

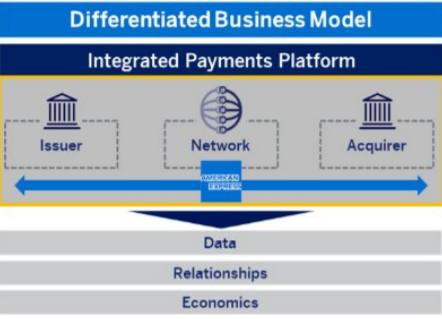

So, how AmEx is different from other players?

AmEx follows the closed-loop model, and as a vertically integrated company, it competes across the payment services value chain.

An end-to-end, integrated payment platform has a direct customer relationship with both card members and merchants. AmEx customer base includes consumers, small businesses, mid-sized and large corporations globally.

And it operates in three reportable segments:

- Consumer Services Group (Global CSG)

- Commercial Services (Global CS)

- Merchant and Network Services (Global MNS)

Registration Open - Analyst Program Click here

So, what is the core business of AmEx?

- Card Issuing: AmEx operates a card issuing business through the GCSG and GCS segment and offers card products, rewards, and services to a diverse consumer and commercial customer base in the US and internationally. The company currently has ~68.9 Bn cards issued with a proprietary billed business (spending on AmEx cards issued by them) of ~$870.7 Bn globally.

- Merchant Acquiring: GMNS reportable segment operates merchants acquiring the business of AmEx, where they build and manage relationships with merchants globally that choose to accept AmEx cards.

- Network Services: AmEx provides licenses to issue its cards to third party banks and other financial services institutions to expand its payment network globally. It currently offers network services in ~98 countries with ~43 Mn cards issued by the third parties with a billed business of ~139.9 Bn.

The US is its primary market, contributes ~70% to AmEx billed business (spending on AmEx cards), and 30% of billed business comes from international markets.

~70% of AmEx billed business comes from Non-T&E (Travel & Entertainment) spending, and ~30% of billed business comes from T&E.

How AmEx generates revenue?

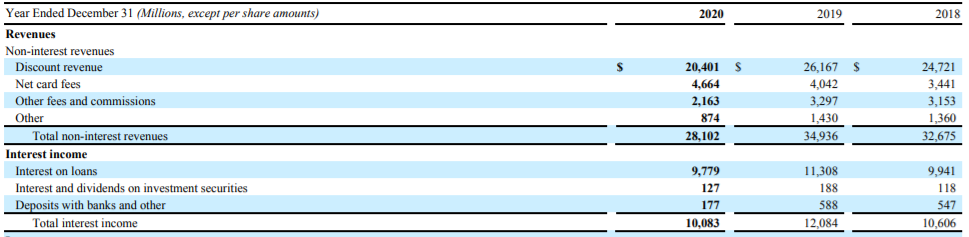

AmEx classifies its revenue as, Non-interest and Interest.

Non-interest revenue generates ~75%, and interest income generates ~25% of the total revenue.

Let’s understand some of the components of revenue.

- Discount Revenue: It is basically the amount that AmEx earn on transactions occurring at merchants that have agreed to accept AmEx cards. The amount charged to merchants is the discount rate that ranges from 1.5% to 5%.

Let’s say we swipe a card at the merchant for a purchase of Rs. 1,000 and AmEx charge 2% as a discount rate to merchant then discount revenue would be Rs 20 (2% of 1,000). Discount revenue is the largest source of revenue for the company and generates ~55% of the total revenue.

- Net card fees: It includes revenue earned from annual card membership fees that varies across cards.

- Other fees and Commissions: This included revenue from merchant services travel commissions and fees, loyalty program and membership rewards program fees.

- Interest on loans: It includes interest income earned on the outstanding loan balance. And generates ~28% of the total revenue for AmEx.

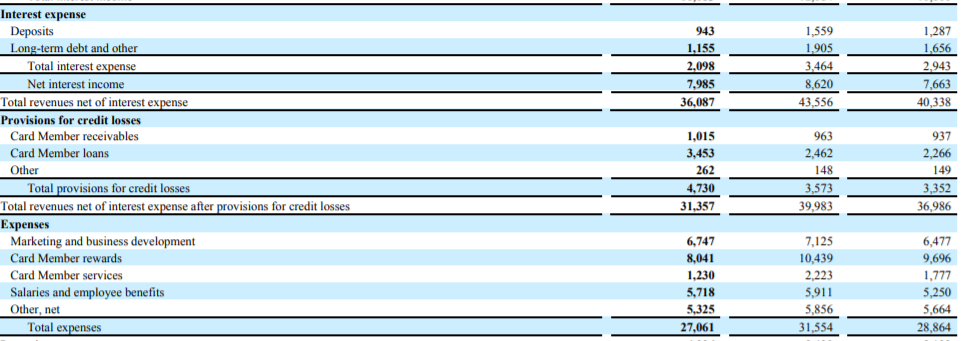

What are the cost drivers?

For credit card companies, the significant cost drivers are membership rewards and marketing.

Businesses spend heavily to acquire new customers on their network and offers huge membership rewards to retain loyal customers.

AmEx spends ~22% of the revenue on Cardmember rewards and ~18% on Marketing and business development.

What about profitability?

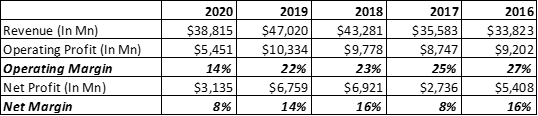

AmEx operates at an average operating margin and a net margin of ~22% and ~13%.

But 2020 has been a challenging year for AmEx as the pandemic’s Travel and entertainment industry was significantly affected. Due to which its T&E billed business decreased by ~61%. And its proprietary consumer and commercial billed business decreased by 17% and 21%, respectively.

Since the pandemic has shaken businesses across sectors globally and reduced the billed business of AmEx significantly, in the coming years, the business’s success would depend upon the digitization and the customer service that they offer in the highly competitive payment industry.

Other Trending Posts in this Series – DMart Valuation | HUL | Tesla Valuation

To stay updated about all of our posts on Businesses and Finance Careers – register and create a free account on our website. You will also get access to a free Finance Bootcamp course once you register.