Inflation has been the buzzword since the last two years and economies have been struggling to put their act together. Whenever we talk about inflation, the man, Paul Volcker, synonymous with the word comes to mind. “Tall Paul” is still the most revered name when it comes to the Fed Reserve. Having served as the Chair of the Federal Reserve between 1979 and 1987, he was highly credited with having ended the high levels of inflation seen in the United States during the 1970s and early 1980s.

Inflation was a severe problem in the United States when Paul Volcker was taking guard. Consumer prices skyrocketed 13% in 1979 and then by the same pace again in 1980.

The Federal Reserve board led by Volcker raised the federal funds rate, which had averaged 11.2% in 1979, to a peak of 20% in June 1981. There was a relentless attempt to bring the prices in control and the prime rate rose to 21.5% in 1981 as well, which helped lead to the 1980–1982 recession, in which the national unemployment rate rose to over 10%.

Volcker, by now, had become the recipient of immense criticism which was a result of the economic crisis that his judgment levied on the state. His theories of tight monetary policy coupled by a large fiscal policy, caused a significant rise in the fiscal deficit for the government.

The pain of the recession had surely kept a check on the rising prices. Once the storm had settled, the Reagan government insisted on lowering interest rates and bringing economic activities back to earlier levels.

The new era of pandemic and uncertainty

Fast forward to 2022 and you will realize that inflationary conditions have been producing spiraling impacts on the economy. The question of the hour is – Do we need another Volcker?

Let’s understand how the situation is different this time and how the Fed needs to keep composure. The problem is deeper and needs a surgeon who would swiftly stitch the wounds inflicted upon by several policymakers.

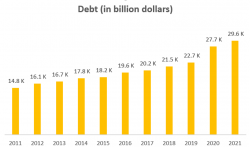

The economy has grown significantly since the last major crisis. Today the US stands as a $ 23 trillion economy. The debt of the economy has skyrocketed to $30 trillion as of January, 2022.

Military spending has also been a big contributor, as has spending on benefits such as Medicare. In 2020 and 2021, spending to offset the effects of the COVID-19 pandemic also added to the debt.

Debt to GDP levels are soaring high

In the days of Volcker, the Debt to GDP ratio was about 35 percent. The last decade saw an increase in the debt levels by at least 2x.

The national debt by year should be compared to the size of the economy as measured by the gross domestic product. The World Bank found that if the Debt to GDP stood above 77 percent for a considerable period, that would slow down the economic growth.

The interest on national debt remained around $250 billion between 2009 and 2015. The costs of the debt didn’t increase as substantially as the debt levels themselves.

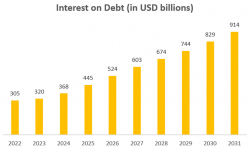

President Joe Biden and the government released the fiscal year budget for 2022 in the first half of 2021. The expected interest on debt has been shared with the public and the resultant impact of debt as a percentage of budget has increased by 2x towards the end of the 10-year period.

When we step into a high interest rate regime, the corresponding impact of interest repayment will pose a challenge at times like these.

The interest on debt has increased by almost 3x during the above period adding on to the existing inflationary pressure.

M2 and money printing

M2 is a measure of the money supply that includes cash, checking deposits, and easily-convertible near money. It is also a broader measure of the money supply than M1, which just includes cash and checking deposits.

To keep things simple, when prices rise, there is an increase in money supply. If the money supply needs to be decreased, deflationary measures are to be adopted. Lower interest rates of the Fed incentivise lending and borrowing.

The Federal Reserve is spending more than creating an increase in the price level. This in turn will automatically have a positive bearing on the tax collections. So, even if tax rates are unchanged, the total tax collections are expected to rise.

Registration Open - Analyst Program Click here

Tax collections and alternatives

The Fed is trying to navigate through this and the government is bringing in different alternatives to assist the budgetary deficit. Rising interest rates beyond a level is not the answer that Powell will have in mind. Moreover, when Volcker came into power, the US was facing inflationary woes for around 6-7 years. As a result he had to take the infamous measures.

US tax collections stand at an average of USD 3.5 trillion in the last couple of years. About 10 percent just clears interest payments on loans.

It is observed that the wealthiest Americans pay a tax of ~3.4%. The rise in difference in tax rates between the wealthiest Americans and the average worker is primarily because of a couple of reasons. Firstly, the wealthy get taxed at a lower rate because much of their wealth is accumulated through investments, like stocks. Secondly, the wealthy are able to use large charitable donations to get huge deductions. The lawmakers are planning to impose a billionaire minimum income tax that should bridge the gap and increase revenue for the government.

Similarly, the government may have to cut short some of its initiatives under the spending programs that it has undertaken over the years. For instance, the Social Security program accounts for 13.3% of national debt.

Future of interest payments

It is observed that if the interest rate rises by 100 basis points, the average annual interest cost would increase by USD 187 billion. Total interest payments from 2022 to 2031 will be around USD 7.3 trillion. Due to this reason, federal deficits would increase by USD 105 billion per year.

The path ahead will surely pose opportunities for revisiting the books. But amongst all the viable options, the Fed would be cautious in being a Volcker yet again.

Other Trending Posts in this Series – DMart Valuation | HUL | Tesla Valuation

To stay updated about all of our posts on Businesses and Finance Careers – register and create a free account on our website. You will also get access to a free Finance Bootcamp course once you register.