If you ask anyone about the potential of India’s Retail Industry then most likely you will get an answer saying, India’s retail market is booming and will continue to grow, considering the population (130 Crores with growth rate of 1-1.5%) and rising per capita income with a young population (average age of India is ~28 years) – it’s obvious that companies should just jump in serving the Retail market. And rightly so, lot of companies have come in to capture the market.

However, when we see the unit economics of retail companies, it doesn’t seem that running the retail business is easy. More so making a consistent profit is difficult. Retail companies work on razor-thin margins, have to manage working capital, have to be operationally efficient, need to manage employees efficiently else the churn/attrition will be high, need to reduce overhead costs and in the end, the companies need to satisfy the customers and eventually make profits for shareholders. We have seen cases of many retail companies around us making losses. The situation around the world is similar.

However, some companies seem to be different. They operate efficiently and generate consistent profits and create huge wealth for shareholders. If you see India, then Avenue Supermarts is one such example. We are doing a detailed Valuation Exercise to understand the market expectation. Register to attend the webinar.

Across the world, few companies have created their niche and operate within that. For example, Walmart – they have created something called EDLP (every day low pricing) strategy and it’s working brilliantly for them. While we will analyze Walmart in a subsequent post, in this post, we are going to discuss Costco. A fascinating company with a fascinating strategy.

So, what is Costco and how do they define themselves?

Costco is the 2nd Largest Retailer in the US after Walmart in terms of revenue generated. When we look at Costco – they define themselves as a warehouse and not the generic retail store or a superstore (like other companies in the USA define themselves). They have the majority of their warehouses in the US and Canada hence it is assumed that their majority of the revenues also comes from the US and Canada.

Now the question arises, is Costco very different when compared it to others?

And the answer is YES.

Let’s understand via three critical parameters.

First Parameter: Number of Stores

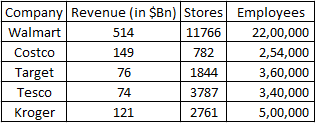

When you compare the number of stores – it is less in number compared to any of the retail store companies in the world. Below is the comparison between Costco and some of the biggest listed Retailers. (here we have made comparisons to other listed giants only and Tesco ‘s numbers are converted to dollars using the conversion ratio of GBP 1 = USD 1.3)

It is evident from the numbers that Costco operates with far lesser number of stores compared to anyone in the industry. They manage to run the operations from less number of stores. This gives them leverage in so many ways. This gives rise to operating efficiency.

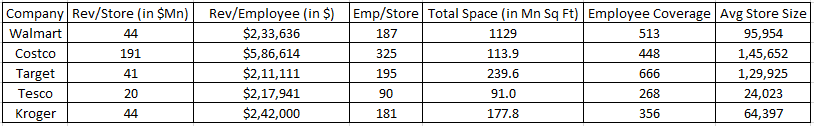

Second Parameter: Operating Efficiency

Because they have a lesser number of stores, it requires a relatively lesser number of employees. The entire efficiency translates into rev/store, rev/employee being higher than every other competitor in the market.

This also translates into higher Profit after tax (PAT) number at each level.

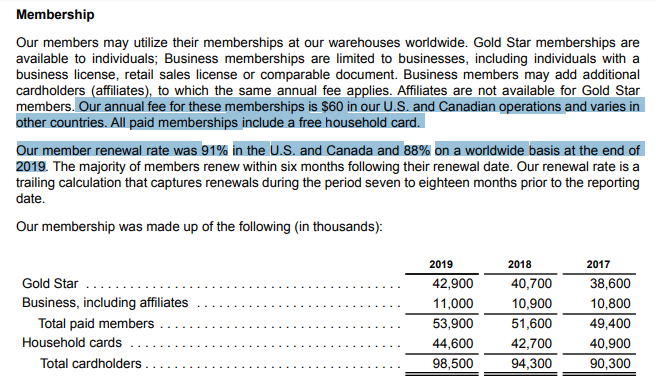

Third Parameter: Slightly different business model (Subscribers)

This brings us to the final question – “How is Costco able to generate such revenue with the least number of stores?”. And the answer lies in the business model.

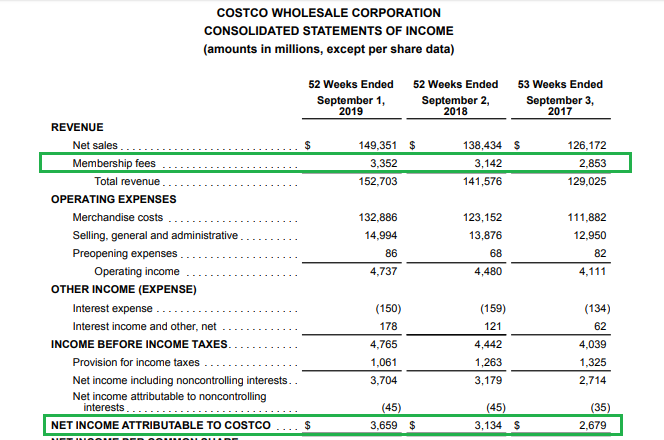

They offer a subscription. That’s something we haven’t heard in Indian Landscape. They want customers to take membership and in return, they will provide the cheapest goods. They offer membership at $60 and above. They have roughly 54 Million paid subscribers. This itself translates to $3 Billion+ in revenues. And customers love it! If you see their renewal rate then you will realize that customers keep coming back and they don’t mind paying subscription fees.

And when you see their overall P&L also, then the net income is close to the revenue which they generate through subscription. That means they charge a minimum margin on the good they sell (around 7-8%).

Some other companies follow the same model as well. Example Walmart generates $4 Bn in revenues from membership and services. But Costco still manages it better by being focused.

First – Almost all Costco warehouses have gas stations. So, a lot of people generally come for gas filling. Secondly, the number of SKUs offered by Costco is limited (say around 3500-4000) compared to what Walmart offers (around 100,000 SKUs).

Costco is one such example which heavily focuses on efficiency. And it is successful. Next, we will decode another company from International Markets. And don’t forget this share this blog post with your friends/batchmates and in your network.

If you are curious to know about DMart – we have a premium webinar for you – on Valuation of DMart where we will discuss in detail about India’s Retail Landscape and DMart in particular.