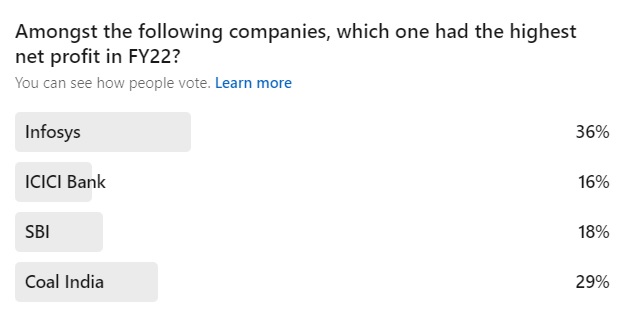

If we were to ask you which of the following companies had the highest net profit in FY22, what would your answer be?

– Infosys

– ICICI Bank

– SBI

– Coal India

We asked this elsewhere, and these were the results.

Just tells us how much we underestimate the largest bank in India by Deposits, Advances, Branch Network, Customer Base, Debit Cards and many other parameters.

Yes, you guessed it right – SBI.

Who has the highest net profit of them all?

Interestingly, the actual order of profits for FY22 is as follows

1) SBI – Rs 35000 crore

2) ICICI Bank – Rs 25000 crore

3) Infosys – Rs 22000 crore

4) Coal India – Rs 17000 crore

SBI has the highest net profit. We have rounded off the numbers, but you get the drift. Profits SBI made are twice that of Coal India, and the top 2 are the ones which most people chose as the numbers 3 and 4. Sometimes narratives trump reality, and companies silently go under the radar growing and building their business.

SBI had a forgettable decade between 2010 and 2020. But that does not mean it is going to always have such years. It’s profit this year is close to the profits of HDFC Bank, and if India sees a credit cycle getting stronger, who knows, we may see Rs 50,000 crore profits in one of the years soon. The trouble SBI faced was a prolonged period where corporate capex in India was very low, and corporates were overleveraged. That is behind us. Even if the current equity markets are making us nervous, the next 3-5 years should be great for credit growth, especially as corporate capex cycle picks up. Would be interesting to see how things stack up for SBI then.

Recent Blog Post

We posted something on Credit Cards and UPI Linkage – Read it here

Recent LinkedIn Infographic

Market Share of Adani Wilmar Products – View it here

Equity Markets have been rough in the past few weeks. We think that we are close to bottoming out. What are your thoughts? Do write to us with your ideas.

Till next week!