Can you imagine a world without WhatsApp, Instagram, Facebook in today’s age. What would our lives be like without these?

Facebook has a fascinating business with solid brands under its umbrella. It thrives on communication and expression of emotions. It is a kind of a company where a consumer is a producer and producer is a consumer. And it just thrives on that. More time you spend on any of the associated platforms, the company makes money.

Let’s try and understand some of the finer nuances and try and answer the questions pertaining to the business.

So, the first thing – how does Facebook make money? (we are talking about a company and not the platform)

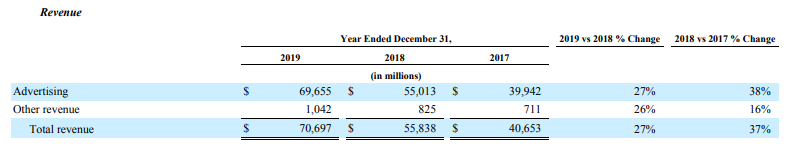

This is not difficult to guess. Obviously it has to be Advertising. Because if customers are on the platform then it’s the obvious choice. Facebook is no exception.

Almost everything which they generate is through advertisements. But the growth is what matters. And most likely the cost of an ad is going down because there’s competition from Google. If the company is growing, most likely the number of ads is increasing. That makes growth numbers even more interesting. Growth of 27% means lots of people are using the Facebook offered platforms to consume ads and hence a lot of people are choosing Facebook offered platforms to promote their ads.

Okay, but how many people are on the platform?

Now, this is an interesting question and this is where the moat lies. Probably this explains the acquisition of WhatsApp and Instagram as well.

The company has 4 main products to offer, namely: Facebook, Facebook Messenger, WhatsApp and Instagram. And collectively it is referred to as “Family”.

The company offers us data at two levels – Daily Active Users (DAU) and Monthly Active Users (MAU). Below two charts give that understanding.

Data shows close to 3 Billion people are active on any one app on a monthly basis. The company tries to come up with a unique number. However, that may happen that one person has accounts on multiple applications, and the company doesn’t recognize it to be a single individual.

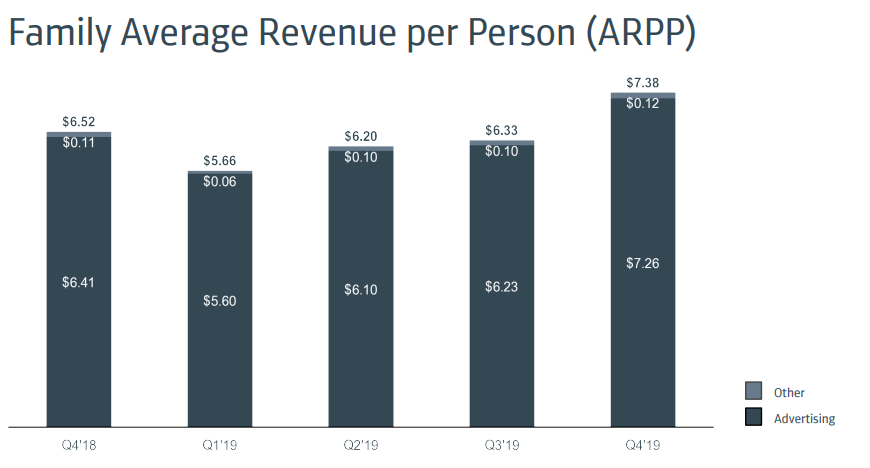

Daily active people throw an interesting premise. So the company gives a ratio of DAP/MAP that means what percentage of the population uses at least one family app daily. And that’s where the moat lies. That number stands at 78% and that’s the trend as well.

A similar analogy would be: you have acquired 100 customers and 78 out of those keep coming for repeat purchase. That’s’ quite amazing honestly. Generally, for most of the business, that business is very less on a daily basis.

Also, think from the perspective that – how many people have an active Internet connection in the world? That’s like 4.5 Billion people. Considering one person has around 2 active accounts from Facebook Family (FB, Messenger, Instagram or WhatsApp) then too 1.5 Billion population use products offered by the company. That itself is an astounding number. (Note: Products offered by Facebook is not available in China, and there are around 1Bn people have access to the Internet in China).

Now that is just amazing. For a company to have 1-1.5 Bn of the world eligible population to be active on any one of the platforms which are offered. This was the thought process behind the acquisition of Instagram and WhatsApp, just to keep consumers active on either of the platforms. That’s the MOAT which Orkut never had because it offered only one platform.

Let’s talk about revenues

The company generates $25.57 per person. How do you compare that actually, whether it is good or bad? Honestly, no other company have footfall/users which is comparable to Facebook Company.

This led us to compare the revenue generated per employee with respect to other major companies. We had done a similar analysis for Amazon, Walmart, Costco and other retailers (Blog post: Where does Walmart go from here and What makes Costco Click ). It is apparent that Facebook generates much higher revenue per employee. It generates approx. $1.5 Mn/Employee compared to Amazon’s $0.35 Mn/Employee, Walmart’s $0.23 Mn/Employee and Costco’s $0.55 Mn/ Employee.

We understand it’s not comparable but this gives you an idea what MOAT it operates with and how difficult it is for someone to break into the business which Facebook operates in. And most likely, if any product becomes big then the likelihood increases that Facebook will buyout that particular medium like it did with Instagram and WhatsApp.

Blog Image Courtesy: fortune.com