Disclaimer: The purpose of this document is purely educational in nature. The idea is to help someone kick-start their analysis of this sector/company. However, this is not to be construed as a recommendation of any sort on the company or its stock. All information has been sourced from publicly available data such as annual reports and news items and the veracity of the sources has not been independently established. Kindly use your judgement while analysing further or using this document.

In the second part of our series on Aviation Sector, we try and answer some specific questions an analyst would have around the sector. You can access the first article of the series here – FinShiksha Sector Insights – Airline Sector in India – Part 1

Just to summarize, in the last article, we introduced the Airline Industry Dynamics in India – passenger and airport details, various operational airline models (full service and low-cost carrier) and industry-specific terminologies and metrics like Available Seat Kilometer (ASK), Revenue Passenger Kilometer (RPK), Passenger Load Factor (PLF) and Yield with illustrations related to how to calculate specific metrics pertaining to the airline industry.

Now coming back to this article which tries and illustrates some pertinent WHY questions.

After the Jet Airlines fallout recently, a question that a lot of people ask is, why do companies in Airline Industry face trouble so often?

- It’s not like this fallout of Jet Airways has happened for the first time. The Indian aviation sector has witnessed the fall of various private airlines over the long period of time: ModiLuft in 1996, Sahara airlines in 2007, Kingfisher in 2012 and most recently JetAirways in 2019.

- Some of the challenges faced by the companies in this sector are high operating and financial leverage and excessive dependency of airlines on fluctuating aviation fuel prices which affects their profitability.

Let us first understand what is operating leverage. Operating leverage is based on the proportion of fixed and variable operating costs in the entire cost structure of the company. Degree of operating leverage studies the effect of an increase/decrease in sales on operating income due to the presence of fixed costs in a company’s cost structure.

Simply put, higher the fixed cost, more the impact of a small change in sales on the Operating profits of the company. High the fixed cost, more is the leverage because even if the company you doesn’t sell and generate any revenues, it still has to bear a fixed cost and can’t get away with it. Similar high fixed cost structures can be found in sectors such as Hotels, Restaurants, Hospitals and Movie Exhibition.

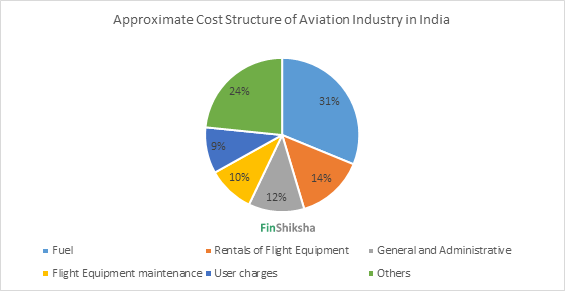

Therefore it is essential to understand the cost structure of companies in the airline sector. The below graph shows the breakup of costs as a percentage of total costs for the aviation industry

*Source: DGCA (others cost include: Sales, Promotion, Ticketing Services and Depreciation)

Other than fuel cost and other costs, all other costs are fixed in nature. From the above graph, it is clearly visible that, ~50% of the cost is fixed in nature. In case of fuel cost if the company’s aircraft do not fly at all during the year, then the total fuel cost will be zero. As the flight hours increases, the total fuel cost will increase.

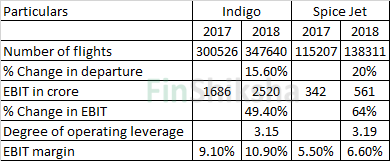

One of the ways to calculate the Degree of operating leverage for an airline can be:

% change in operating income (EBIT) / % change in the number of departures

- It can be inferred that as the number of flights increases the fixed costs are spread across a greater number of departures, so the additional flights have a lower ratio of fixed costs to total costs. Hence the higher percentage growth in EBIT.

Another interesting phenomenon which plays out in this Industry is the price war. As the companies have already incurred the fixed cost, to cover the already incurred fixed cost the company needs to attract more passengers even if it is at a lower price point.

So as long as the next ticket sold can cover the variable costs of the person travelling, it does not create an additional loss for the company. This results in companies resorting to price war, in order to garner market share in the short term. They want to increase the market share takes precedence over profitability in the short run. This is true for all sectors where you see high fixed costs. Price wars are common in sectors with high fixed costs.

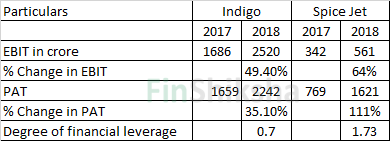

- Along with high operating leverage, companies in the aviation sector also experience high financial leverage due to the capital intensive structure of the sector.

- Financial leverage refers to the amount of debt used to finance the operations of a company. The degree of financial leverage measures the effect of increase/decrease in operating earnings on net profit due to the presence of debt in the company’s capital structure.

One of the ways to calculate the Degree of financial leverage for an airline can be:

% change in Net income (PAT) / % change in operating income (EBIT)

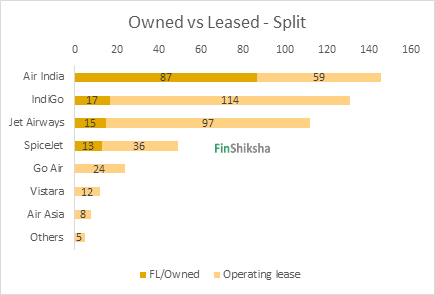

Spice Jet has higher financial leverage than Indigo indicating that Spicejet uses more debt to finance its asset than Indigo. This is supported by the fact that Indigo’s borrowings to capital employed is at 11% while that of Spicejet is 25%.

How does Aviation Turbine Fuel (derivative of crude oil) affect the Airline Industry?

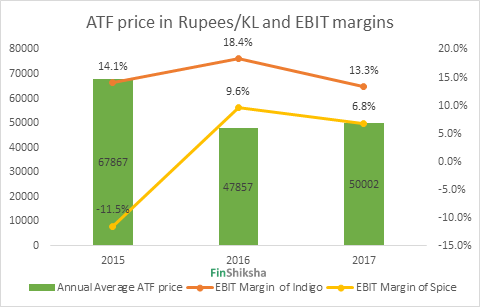

- Jet fuel (Aviation Turbine Fuel – ATF) is a major cost for airlines. As we see from the first graph, approximately 31% of the cost goes to ATF. The ATF price is announced every month for the various airports in the country, based on the prevailing exchange rate and global fuel prices. This volatility in fuel prices, adds to the normal operational risk of an airline. The only step that they can take is improving the fuel efficiency of aircraft by increasing block hours or employing fuel-efficient aircraft.

During a period of high fuel cost, the profitability of airline companies is greatly affected as companies cannot pass on the entire increase in fuel cost to its customers due to high competition. We already know airline sector gets affected by price wars. Below graph shows the movement of ATF prices and Profitability.

After reading all the data and analysis, a lot of you may have a question that if the Airline Industry is that difficult then why do so many business houses want to have an Airline?

Why companies are still investing in the aviation sector?

- India is the fastest growing airline market as per the International Air Transport Association (IATA) for the past three years followed by China. It is now the third largest aviation market in the world with growth rates that leave the US and China behind.

- A lot of the investors and businesses operating or wanting to get into the airline industry believe that while in the short term they may bleed, in the long run the industry would consolidate – something that has happened in the US, and then the pricing will become stable. A small evidence of this is available as most airlines have maintained higher prices in the recent times, in the wake of Jet Airways closure. This may indicate that some pricing discipline may be creeping in.

- Investors are expecting that airline operators would be able to achieve optimum consumer engagement resulting in consumer loyalty. These consumers are less price sensitive. Hence over a period of time airlines will be able to increase consumer yield. Kingfisher Airlines tried that path and succeeded to some extent.

- People expect that fuel prices may be lower in the future, given the advent of electric vehicles. So maybe, the aviation industry will not depend on the fuel price volatility as much.

Why do airlines lease aircrafts? Can’t they just buy them?

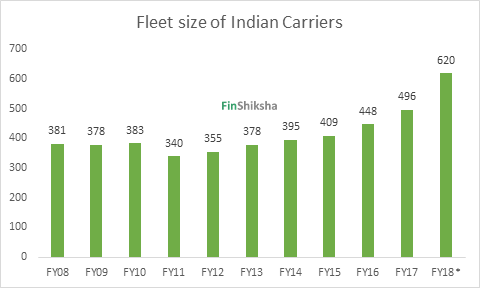

Just to put some perspective, Indian Carriers operated 620 aircrafts in 2018 up from 381 in FY08. And nearly 3/4th of the fleet as on are on operating lease.

- There is duopoly in the commercial aircraft manufacturing business comprising of Airbus and Boeing primarily. This duopoly owns the sky by making up 99% of global large airplane orders, and those large airplane orders make up more than 90% of the total airplane market according to the Teal Group, an aerospace market analysis company.

A Boeing plane would cost anything between $82.4 million to $408.8 million.

- Buying a single carrier is a very large CAPEX for any airline; hence airlines normally lease aircraft as leasing helps the airlines to operate aircraft without the financial burden of buying them. Leasing can also help to provide temporary increase in capacity if needed. Even during a period of a sudden increase in demand, airlines can simply lease aircraft for a short period without any financial burden hence providing flexibility to operators by adjusting capacity for demand in the market.

- The airline’s strategy has been to maintain short leasing contracts and keep replacing aircraft before they come up for heavy maintenance checks.

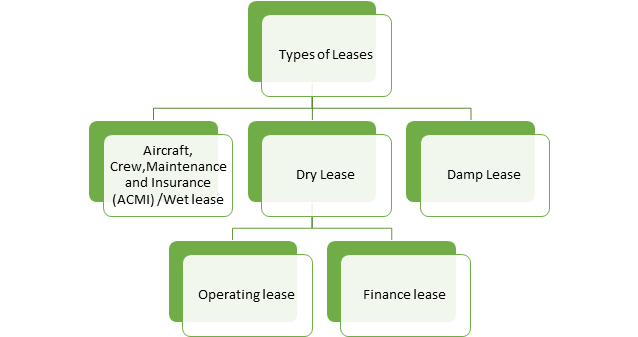

At this point, let’s understand various leasing types and concepts.

- Wet lease – In case of a wet lease or Aircraft, Crew, Maintenance and Insurance(ACMI) lease, the lessor i.e. the company leasing out the aircraft provides the crew, including pilots, engineers and flight attendants, besides maintenance and insurance, to the lessee i.e. the company/airline operator who takes the aircraft on lease. Irrespective of whether the plane flies or not, the lessee has to pay for the minimum guaranteed block hours fixed by the lessor.

- Dry lease – A dry lease does not include crew, maintenance or insurance. The average tenure of a dry lease is typically more than two years. Dry lease is of two types:

- Operating lease

- In an operating lease, an aircraft is leased out for a short period of time compared to its total life. For instance, if the life of an aircraft is twenty (20) years, it would be leased out for a period of about eight (8) years. Upon the end of the lease period, the lessee returns the aircraft to the lessor and there is no option for purchasing the aircraft.

- Leases where the lessor effectively retains substantially all the risks and benefits of ownership of the leased aircraft are classified as operating leases.

- Operating lease payments are recognized as an expense in the statement of profit and loss.

- One of the most used forms of operating lease is the sale and lease-back model. Under this model the operator/Airline purchases the aircraft from manufacturers (as manufacturers sell their aircraft at a lower price to operators than to leasing companies) who then sells it to a lessor and later leases it back from the lessor. Airlines often sell their new planes at a premium to their buying price to leasing companies and free up cash by leasing them back. At the end of the lease, the aircraft is returned back to the lessor who takes on the residual value risk associated with the aircraft.

- Financial lease:

- A finance lease is a long-term lease and the lessee can purchase the aircraft on the completion of the lease period. The lease payments are in excess of 90% of the market value of the aircraft and the term of the lease is over 75% of the aircraft’s usable life.

- Leases, where the airline retains substantially all the risks and benefits of ownership of the leased aircraft, are classified as financial leases

- Operating lease

- Damp lease – Damp lease is wet lease sans the cabin crew, which means the lessor provides for maintenance and insurance of the aircraft it leases out but does not provide a crew to the lessee.

Some other key points to note are

- There are no lessors based in India hence Indian airlines depend on global lessors. Due to this Indian airlines have a huge exposure towards foreign exchange because lease rentals are largely paid in dollar formulating a substantial part of an airline’s expenditure. This leaves the opportunity open for an Indian player to enter into the leasing business in future. If that happens, it would be good for the aviation industry. However, only players with deep pockets can venture into this leasing business.

- It is important to note that earlier Accounting standard Ind-AS 17 allowed companies to keep operating leases as off-balance sheet items and a single charge in the income statement as rent.

- According to the new Ind-AS 116 accounting for leases which come into effect from FY20, requires long-term liability toward operating lease payment to be recognised on the balance sheet, in the form of a ‘right-to-use’ asset and a lease liability, thereby making balance sheet ‘asset heavy’ and ‘indebted.’ The aviation industry balance sheets will optically suffer the most from this change of accounting standards as airlines finance most of the aircrafts through off-balance sheet operating leases.

The next part on our insights on Aviation Industry will discuss what are the risks and opportunities in the sector, and how do we evaluate the aviation companies and their financials.