Why is the INR touching 80 against the USD?

Before we dive into why is the INR touching 80 against the USD, a quick announcement! FinShiksha Learning Championship 2022 is launching in 2 weeks. If you are a student of an MBA Program and are graduating in 2023 or 2024, you can be a part of this by enrolling for the courses enlisted under your year. The winners stand to win cash prizes worth Rs 3.5 lakhs, and access to some placement opportunities at top corporates. For more details, please visit the details of last year’s Championship, or fill the form here and our team will reach out to you.

Let’s come back to the Rupee

While there are many factors affecting currencies, and one of the major ones is that the US is raising rates, thereby making the dollar stronger against most currencies, it is important to look at what our own trade dynamics are.

Let’s look at Merchandize Trade Data for India (Only goods – we are not looking at services here, where we are a net exporter. However, the deficit in goods is bigger than the trade surplus in services)

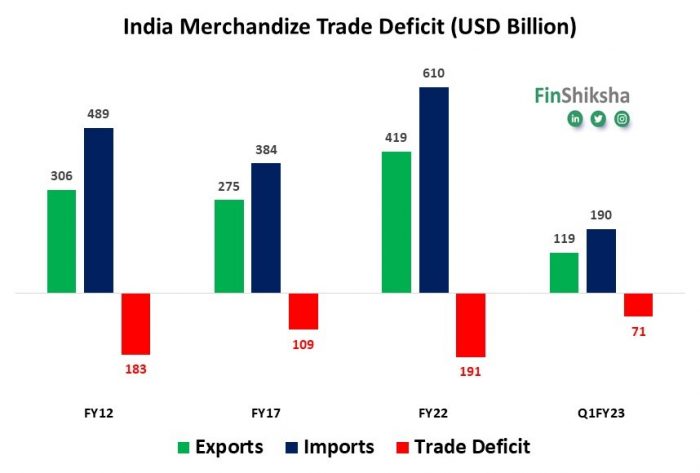

India used to import nearly USD 500 billion worth of goods in 2012. Nearly 32% of this was oil. Exports around the same year used to be close to USD 300 billion, giving a rough Trade Deficit of USD 180-190 billion. Between 2014 and 2017, as oil prices fell, we managed our deficit well, and this resulted in our forex reserves building as well.

What’s happened in recent times?

However, in the past 12-18 months, with commodity prices spiking, and demand being relatively inelastic, we have a situation where the value of imports has gone up significantly. In the first quarter of FY23, we have seen a Trade Deficit of USD 70 billion! If this continues, the annualized trade deficit will be USD 280 billion! We have not had this more than USD 200 billion in any of the past 10 years.

Additionally, in a bid to control domestic inflation, we put restrictions on some exports (Steel, wheat etc). This on the margin aggravated the trade deficit.

The question is, why are imports rising? Well, prices are jumping, and as an economy, India is doing ok, so demand has not come off. Top 3 imports for India are Oil, Gold/Silver, and Electronic Items. All 3 have shown massive growth in value terms in Q1FY23

We have had a tricky past 8 months, with continuous FII Selling, and a larger trade deficit due to global inflation. All this is clearly putting a pressure on the rupee. That said, the INR has done relatively well against the USD when compared to some other currencies.

Recent LinkedIn Posts

Can Tata Trent replicate the performance of Westside for other brands – View it here

Latest Blog Posts

The US economy: Where the buck stops – Read it here

Till next week. Keep reading, and keep learning!