We recently had a large surge in IPOs in the Indian markets, before the much awaited correction took the wind out of some of the recently listed IPOs. Paytm was the most punished, but some others like CarTrade and PolicyBazaar were also not spared. Nykaa too fell almost 50% from the top it established right after the IPO.

Now there is a marquee line up for the next few months as well. LIC, Bikaji, Navi, Ola, Delhivery, Macleod Pharma are some of the major names planning an IPO listing soon. So this brings us to our question.

Should one really invest in IPOs?

The most important question you need to answer here, is if the company is playing a long term game. If the company is playing a long term game, they cannot afford to short change investors at the first stage by trying to overprice the IPO as much as they can. Just because there is market frenzy, it does not mean that the company can take investors for a ride. Such companies do not remain unpunished by the capital markets for too long. There are stories after stories around the same.

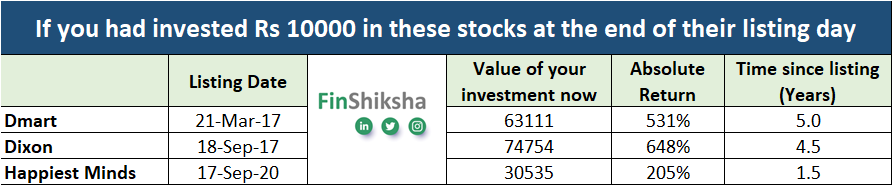

Another aspect is more behavioral. If you think the company is actually playing a long term game, would you really bother thinking about listing premium. Even if the company lists 100% higher, and you believe the growth potential is huge, would it matter what price you paid on day 1 of a company’s listing? With the benefit of hindsight – would it have mattered if you had bought DMart, Indiamart, IRCTC, Happiest Minds, Dixon Technologies post listing on day 1, as against in the IPO.

In any case, if everyone knows that the company is a good one, chances of getting decent allocations in the IPO are very low.

And if the IPO is not so good, you might as well avoid it.

So there you go – broadly speaking, as a thumb rule of investing, avoiding IPOs is generally a good idea. If you really like the long term story, you can buy post listing. 50-100% gains in a decade long wealth creation story is not necessarily going to change the dynamics. Of course, it would be great to capture that return as well, but that depends on external factors such as IPO allocation. If you think the company is playing a long term game, and the opportunity is large, never let the behavioral bias of the stock having jumped up on listing day come in your way of investing in a great company.

If you are playing for short term gain, this only works about 20% of the times. This strategy works in bull market phases. However, if you analyze IPOs from 2010 to 2018 from listing gains perspective, you will realize the folly of running behind IPOs for listing gains.

Disclaimer: This does not mean you apply or do not apply in any and every IPO. But understand that wealth creation does not happen by listing gains in IPOs. Wealth creation happens by riding the growth wave with good companies over a decade or more.

Recent YouTube Videos

5 top sources for Macroeconomic Data on India – Watch it here

What makes DMart Special? – Watch it here

We would love to have your suggestions on what topics you want us to create more videos on. Just share your thoughts by replying to this email.

Recent LinkedIn posts

Category-wise packaged food retail market in India – Read it here

Till next week. Keep learning.